Understanding The Garrett County Tax Map: A Comprehensive Guide

Understanding the Garrett County Tax Map: A Comprehensive Guide

Related Articles: Understanding the Garrett County Tax Map: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding the Garrett County Tax Map: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Understanding the Garrett County Tax Map: A Comprehensive Guide

- 2 Introduction

- 3 Understanding the Garrett County Tax Map: A Comprehensive Guide

- 3.1 The Importance of the Garrett County Tax Map

- 3.2 Navigating the Garrett County Tax Map

- 3.3 FAQs Regarding the Garrett County Tax Map

- 3.4 Tips for Utilizing the Garrett County Tax Map

- 3.5 Conclusion

- 4 Closure

Understanding the Garrett County Tax Map: A Comprehensive Guide

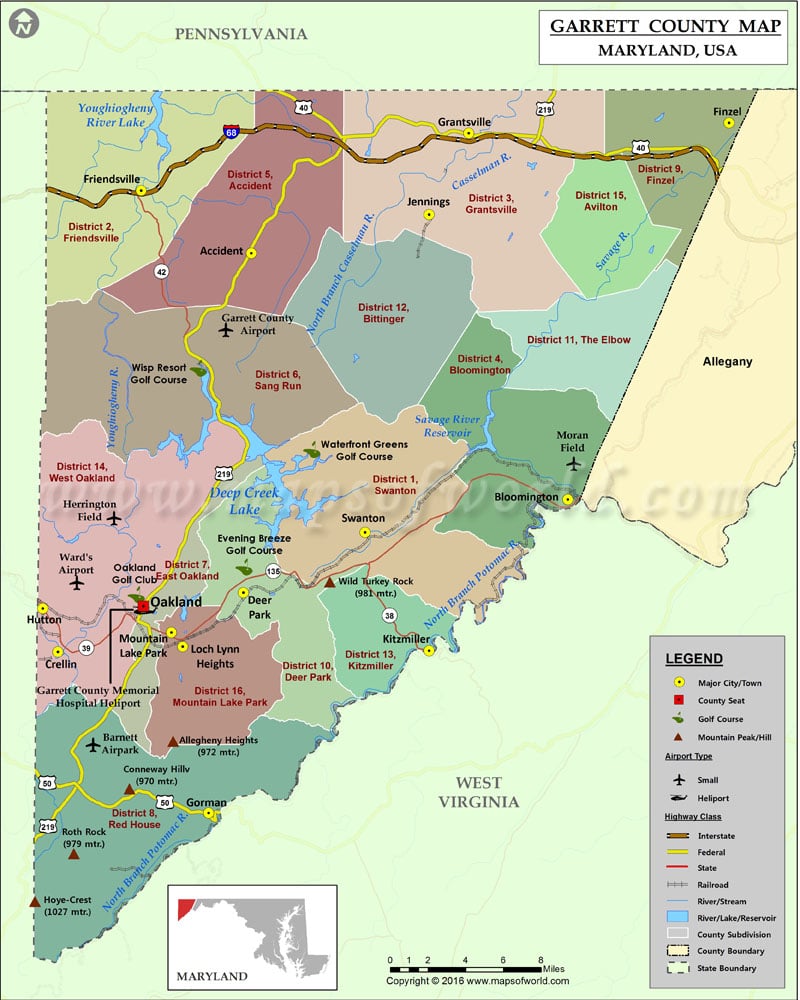

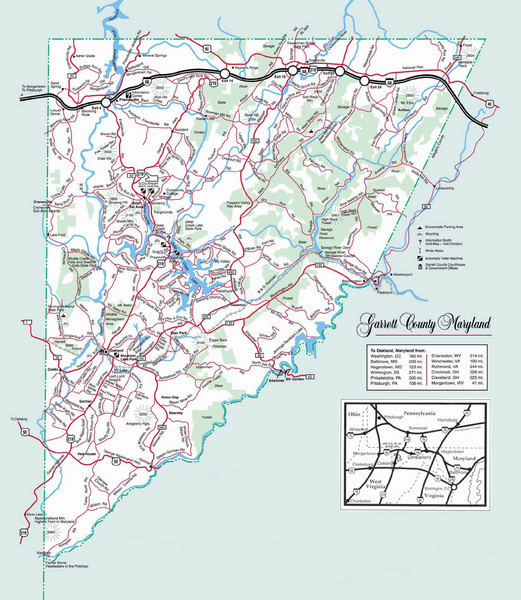

The Garrett County Tax Map, a vital resource for residents, businesses, and government entities, serves as a comprehensive and organized representation of all real property within the county. This map, maintained and updated by the Garrett County Department of Assessments, provides a detailed visual and informational framework for understanding property ownership, boundaries, and tax information.

The Importance of the Garrett County Tax Map

The Garrett County Tax Map plays a critical role in various aspects of county administration and public life:

1. Property Assessment and Taxation: The map is the foundation for accurately assessing property values and determining fair tax obligations. It provides detailed information on land size, improvements, and zoning, enabling assessors to make informed valuations.

2. Property Identification and Location: The map serves as a definitive guide for identifying and locating specific properties within the county. It utilizes a unique parcel identification number (PIN) for each property, allowing for precise tracking and referencing.

3. Land Use Planning and Development: The map provides crucial insights into existing land use patterns, helping planners and developers understand property boundaries, zoning regulations, and environmental factors. This information is vital for informed decision-making related to development projects, infrastructure planning, and environmental conservation.

4. Emergency Response and Public Safety: The map is an invaluable tool for emergency responders, providing detailed information on property locations, access routes, and potential hazards. This allows for efficient deployment of resources and improved response times during emergencies.

5. Public Access to Information: The Garrett County Tax Map is publicly accessible, providing transparency and enabling residents and businesses to access essential information regarding property ownership, boundaries, and tax details.

Navigating the Garrett County Tax Map

The Garrett County Tax Map is primarily accessed through the online portal of the Garrett County Department of Assessments. This portal offers a user-friendly interface, allowing users to search for specific properties by PIN, address, or owner name.

The map itself is typically presented as an interactive digital map, allowing users to zoom in and out, pan across the county, and select specific properties. Each property is represented by a distinct parcel boundary, with accompanying information such as:

- Parcel Identification Number (PIN): A unique identifier for each property.

- Property Address: The official address associated with the property.

- Owner Name: The name of the current property owner.

- Property Type: Categorization of the property (e.g., residential, commercial, agricultural).

- Land Use: The current designated use of the property.

- Zoning: The zoning designation applicable to the property.

- Assessed Value: The estimated market value assigned to the property.

FAQs Regarding the Garrett County Tax Map

Q: How can I find my property on the map?

A: You can access the map online through the Garrett County Department of Assessments website. Search by PIN, address, or owner name to locate your property.

Q: What is the purpose of the PIN?

A: The PIN is a unique identifier assigned to each property, allowing for accurate identification and tracking across various county records and systems.

Q: How are property values assessed?

A: Assessors utilize a combination of factors, including market analysis, comparable sales, and property features, to determine the assessed value of each property.

Q: How often are property assessments updated?

A: Property assessments are typically updated every three years, or more frequently if significant changes occur to the property.

Q: Can I challenge my property assessment?

A: Yes, you can appeal your property assessment if you believe it is inaccurate. The Department of Assessments provides detailed instructions and procedures for filing an appeal.

Q: How can I contact the Department of Assessments?

A: Contact information for the Department of Assessments, including phone numbers and email addresses, is available on their website.

Tips for Utilizing the Garrett County Tax Map

- Familiarize yourself with the map’s interface: Take time to understand the map’s features and navigation tools before beginning your search.

- Utilize the search functionality: The map’s search function is a powerful tool for locating specific properties efficiently.

- Review property details carefully: Pay close attention to the information associated with each property, including the PIN, address, owner name, and assessed value.

- Use the map for planning purposes: The map can be a valuable resource for planning development projects, identifying potential locations for businesses, and understanding land use patterns.

- Contact the Department of Assessments for assistance: If you have any questions or need clarification regarding the map or its information, reach out to the Department of Assessments for support.

Conclusion

The Garrett County Tax Map serves as a vital resource for understanding property ownership, boundaries, and tax information within the county. It plays a crucial role in property assessment and taxation, land use planning, emergency response, and public access to information. By leveraging this map’s capabilities, residents, businesses, and government entities can make informed decisions, ensure transparency, and contribute to the effective administration of Garrett County.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Garrett County Tax Map: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!